SMM June 26 Report:

Today, spot primary aluminum prices rose by 80 yuan/mt compared to the previous trading day. SMM A00 aluminum ingot prices closed at 20,610 yuan/mt, while aluminum scrap market prices remained largely unchanged from yesterday. Amid the traditional off-season, downstream scrap utilization enterprises are experiencing weak order releases, with procurement primarily driven by immediate needs.

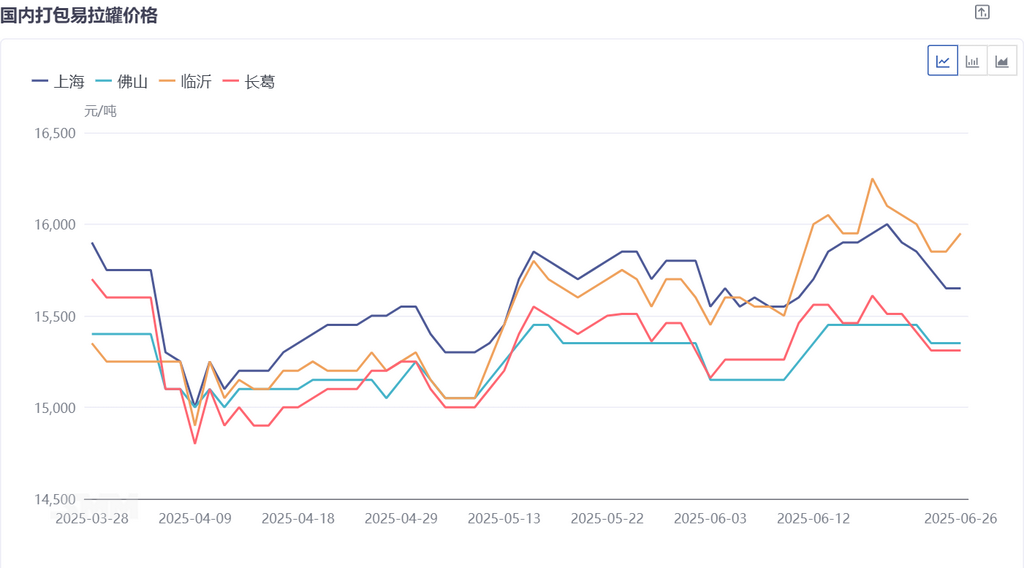

Today, the centralized quoted price for baled UBC aluminum scrap ranges from 15,200 to 15,700 yuan/mt (tax-exclusive), while the centralized quoted price for shredded aluminum tense scrap ranges from 15,800 to 17,300 yuan/mt (tax-exclusive). Regionally, Shanghai, Jiangsu, Shandong, and other regions closely track aluminum prices, with price adjustments ranging from 0 to 50 yuan/mt. Jiangxi province has maintained a firm stance on prices, with no price adjustments observed this week. In terms of products, baled UBC aluminum scrap has followed the downward trend of aluminum prices since last Thursday, with a cumulative price reduction of 150-200 yuan/mt.

Regarding the price difference between A00 aluminum and aluminum scrap, the price spread for mechanical casting aluminum scrap in Shanghai remained unchanged at 1,840 yuan/mt, while the price difference between A00 aluminum and mixed aluminum extrusion scrap free of paint in Foshan increased by 70 yuan/mt from yesterday to 1,557 yuan/mt.

Considering the actual difficulty in shipping goods, aluminum scrap suppliers have adopted a cautious and wait-and-see attitude towards price adjustments amid the high-level fluctuations of aluminum prices. Next week, the aluminum scrap market is expected to continue its high-level fluctuation pattern.